Managing a startup budget can be challenging. Every dollar counts, and keeping track of expenses is crucial.

That’s where budget management apps come in. These tools help you stay on top of your finances, ensuring that you make the most of your limited resources. Startups often struggle with financial management due to limited funds and resources. Effective budgeting is key to survival and growth.

Budget management apps offer a solution by providing a clear picture of your financial health. They help you track income, expenses, and forecast future costs. With the right app, you can make informed decisions, avoid overspending, and plan for the future. In this blog post, we’ll explore some top budget management apps designed to help startups thrive.

Credit: www.nevinainfotech.com

Introduction To Budget Management Apps

Budget management is crucial for startups. It ensures funds are used wisely. Many startups fail due to poor financial management. To avoid this, startups need budget management apps. These apps help track expenses, forecast cash flow, and manage budgets. They are essential for maintaining financial health.

Importance For Startups

Startups often operate with limited funds. Efficient budget management is vital. It helps in avoiding overspending. It also ensures funds are available for critical needs.

Budget management apps provide real-time insights into financial status. This helps in making informed decisions. Startups can track expenses, set financial goals, and monitor progress. This is crucial for growth and sustainability.

Criteria For Choosing Apps

Choosing the right budget management app can be challenging. Here are some criteria to consider:

- Ease of Use: The app should be user-friendly. It should have a simple interface.

- Features: Look for features like expense tracking, budget planning, and financial reporting.

- Compatibility: Ensure the app is compatible with various devices. This includes smartphones, tablets, and computers.

- Security: The app should have strong security measures. This protects sensitive financial data.

- Cost: Consider the cost of the app. It should fit within the startup’s budget.

By considering these criteria, startups can choose the best budget management app. This will help in managing finances effectively.

Credit: cloudvisor.co

Need more clarity on Accounting and Finance? This post provides the answers you're seeking. Comparison of Accounting Software for Freelancers: Best Picks

Benefits Of Budget Management Apps

Startups often face the challenge of managing their finances effectively. Budget management apps can help streamline this process. These apps offer several advantages that are crucial for new businesses. Let’s dive into the benefits of budget management apps for startups.

Cost Efficiency

One of the main advantages of budget management apps is cost efficiency. Startups usually operate on limited budgets. These apps help in minimizing unnecessary expenses. They offer features like:

- Tracking expenditures

- Setting budget limits

- Generating financial reports

These features help businesses to understand their spending patterns. This enables better financial planning and resource allocation.

Time Saving

Another significant benefit is time saving. Managing finances manually can be a time-consuming task. Budget management apps automate many of these processes. Key features include:

- Automated expense tracking

- Quick report generation

- Integrated payment systems

By automating these tasks, startups can focus more on their core activities. This leads to increased productivity and efficiency.

Top Free Budget Management Apps

Managing a budget can be challenging for startups. Finding the right tools is crucial. Thankfully, there are free budget management apps that can help. These apps offer various features to help manage finances efficiently. Below are some of the top free budget management apps for startups.

Features Of Free Apps

Free budget management apps come with several useful features. These features make financial management easier. Many apps offer expense tracking. This feature helps monitor where money is going. Some apps provide income tracking. This helps keep an eye on revenue streams. Budget categorization is another common feature. It allows users to divide expenses into categories. This makes budgeting more organized.

Several apps also offer financial reporting. This feature provides detailed insights into financial health. Some apps include reminders for bill payments. This helps avoid late fees. Integration with bank accounts is also common. It simplifies tracking of transactions. Many free apps are user-friendly. They often have simple and intuitive interfaces. This makes them suitable for non-native English speakers.

Interested in Accounting and Finance? We've got you covered with this resourceful post. Best Accounting Tools for Small Businesses: Boost Efficiency Today

Best Free Apps

Several apps stand out for budget management. Mint is a popular choice. It offers comprehensive budgeting tools. Users can track expenses and income. Mint also provides financial reports. Another great app is Personal Capital. It offers budgeting and investment tracking. Users can monitor their spending and investments.

YNAB (You Need A Budget) is another excellent option. It helps create detailed budgets. Users can assign every dollar a job. This encourages disciplined spending. GoodBudget is also worth mentioning. It uses the envelope budgeting method. Users can allocate money into different envelopes for various expenses.

These free apps offer great features for startups. They help in efficient budget management. Choosing the right app depends on specific needs. Evaluate the features before deciding. Start managing your budget today with these free tools.

Top Paid Budget Management Apps

Managing a startup’s budget can be challenging. Paid budget management apps can ease this process. These apps offer advanced features that free apps may lack. They help startups track expenses, manage cash flow, and plan for the future.

Features Of Paid Apps

Paid budget management apps offer robust security. They protect sensitive financial data with encryption. These apps also provide detailed financial reports. This helps in better decision-making. Another feature is multi-user access. It allows team collaboration on budgeting tasks. Customizable alerts and reminders are also common. They help in staying on top of financial goals.

Best Paid Apps

QuickBooks: QuickBooks is popular among startups. It offers expense tracking, invoicing, and payroll services. The app integrates with many other tools, making it versatile.

Xero: Xero is known for its user-friendly interface. It provides real-time cash flow updates. The app also offers inventory management and multi-currency support.

FreshBooks: FreshBooks is great for small businesses. It excels in invoicing and expense tracking. The app also offers time tracking and project management features.

Wave: Wave is another excellent choice. It offers accounting, invoicing, and receipt scanning. The app provides a good balance of features and affordability.

Enhance your knowledge on Accounting and Finance by exploring this related piece. How to Manage Business Finances With Software: Boost Efficiency

Comparison Of Free Vs Paid Apps

Selecting the right budget management app is crucial for startups. There are many free and paid apps available. Each has its pros and cons. Understanding these can help startups make an informed decision. This section will compare free and paid budget management apps.

Pros And Cons

| Type | Pros | Cons |

|---|---|---|

| Free Apps |

|

|

| Paid Apps |

|

|

Suitability For Different Needs

Free apps are suitable for startups with small teams. They offer basic features to manage budgets. These apps are ideal for those who do not need advanced tools.

Paid apps are better for larger teams. They provide advanced features and customer support. These apps are suitable for startups that need detailed financial tracking.

Choosing between free and paid apps depends on your startup’s needs. If you need more features and support, paid apps are a better choice. For basic needs, free apps can suffice.

Integrating Apps With Accounting Software

Integrating budget management apps with accounting software can streamline financial processes. It helps startups manage their finances more effectively. This seamless integration can save time and reduce errors. Here are some key points about integrating apps with accounting software.

Popular Accounting Software

Many startups use accounting software to keep their finances in check. Some of the most popular options include:

- QuickBooks: Known for its ease of use and comprehensive features.

- Xero: Offers robust accounting tools and excellent customer support.

- FreshBooks: Ideal for small businesses and startups with its user-friendly interface.

- Zoho Books: Integrates well with other Zoho products, offering a complete business solution.

Integration Benefits

Integrating budget management apps with accounting software offers several benefits:

- Real-time Financial Data: Get up-to-date financial information without manual entry.

- Reduced Errors: Minimize the risk of human errors in data entry.

- Time Efficiency: Save time by automating repetitive tasks.

- Improved Accuracy: Ensure accurate financial records through seamless integration.

- Enhanced Reporting: Generate detailed reports with integrated data.

A table can also be useful to summarize the integration benefits:

| Benefit | Description |

|---|---|

| Real-time Financial Data | Access the latest financial information instantly. |

| Reduced Errors | Lower the chances of mistakes in financial records. |

| Time Efficiency | Automate tasks to save valuable time. |

| Improved Accuracy | Ensure precise financial records and reporting. |

| Enhanced Reporting | Create detailed and comprehensive financial reports. |

Overall, integrating budget management apps with accounting software can greatly benefit startups. It simplifies financial management and boosts efficiency.

User-friendly Interfaces

Startups often need budget management apps that offer ease of use. A user-friendly interface can save time and reduce errors. It’s crucial for new businesses to have an intuitive tool. Let’s explore some important aspects.

Ease Of Use

Ease of use is a top priority for any budget management app. Startups need to quickly understand and navigate the app. The interface should be clean and not cluttered. Icons and menus should be easy to find.

- Simple Dashboard: A clear dashboard gives a snapshot of finances.

- Quick Access: Important features should be one click away.

- Guided Setup: Step-by-step setup helps new users.

A user-friendly app reduces the learning curve. This is important for startups with limited time and resources.

Customization Options

Customization options allow startups to tailor the app to their needs. Different businesses have different requirements. The app should adapt to these unique needs.

- Custom Reports: Generate reports specific to your business needs.

- Personalized Alerts: Set alerts for important financial events.

- Flexible Categories: Create categories that match your expense types.

With customization, startups can manage their budget in a way that suits them best. This flexibility is key to effective financial management.

In summary, user-friendly interfaces with ease of use and customization options can greatly benefit startups. They help in managing finances efficiently and effectively.

Security And Data Privacy

In the digital age, security and data privacy are critical for startups. Protecting financial data is crucial. This ensures the long-term success and reputation of the business. Budget management apps play a vital role in this regard. They help startups manage their finances efficiently while safeguarding sensitive information.

Importance Of Security

Security is the backbone of any budget management app. Startups handle a lot of sensitive financial data. This includes bank details, transaction records, and investment information. If this data falls into the wrong hands, it can lead to severe financial losses and legal issues.

Investing in secure budget management apps is a necessity. These apps offer robust security features. This includes encryption, multi-factor authentication, and regular security updates. They ensure that all financial data remains safe from cyber threats.

Top Secure Apps

| App Name | Security Features |

|---|---|

| Mint |

|

| YNAB (You Need A Budget) |

|

| Personal Capital |

|

Using these apps ensures that your startup’s financial data is well-protected. They offer top-notch security features. This provides peace of mind to business owners. Choosing the right app can make a significant difference.

Real-time Financial Tracking

Real-time financial tracking is vital for startups. It provides instant updates on expenses and income. This helps in making quick decisions. Understanding your financial health at any moment is crucial. Real-time tracking can prevent overspending and keep you on budget.

Benefits Of Real-time Tracking

Real-time tracking offers many benefits. First, it provides instant updates. This means you always know your financial status. Second, it helps in quick decision-making. You can adjust budgets on the fly. Third, it prevents financial surprises. Regular updates mean fewer chances of missing something.

Best Apps For Real-time Tracking

Several apps excel at real-time financial tracking. One of the best is Mint. It syncs with your bank accounts and provides instant updates. Another great option is QuickBooks. It offers comprehensive financial management and real-time insights. Lastly, FreshBooks is ideal for startups. It provides real-time tracking and easy-to-understand reports.

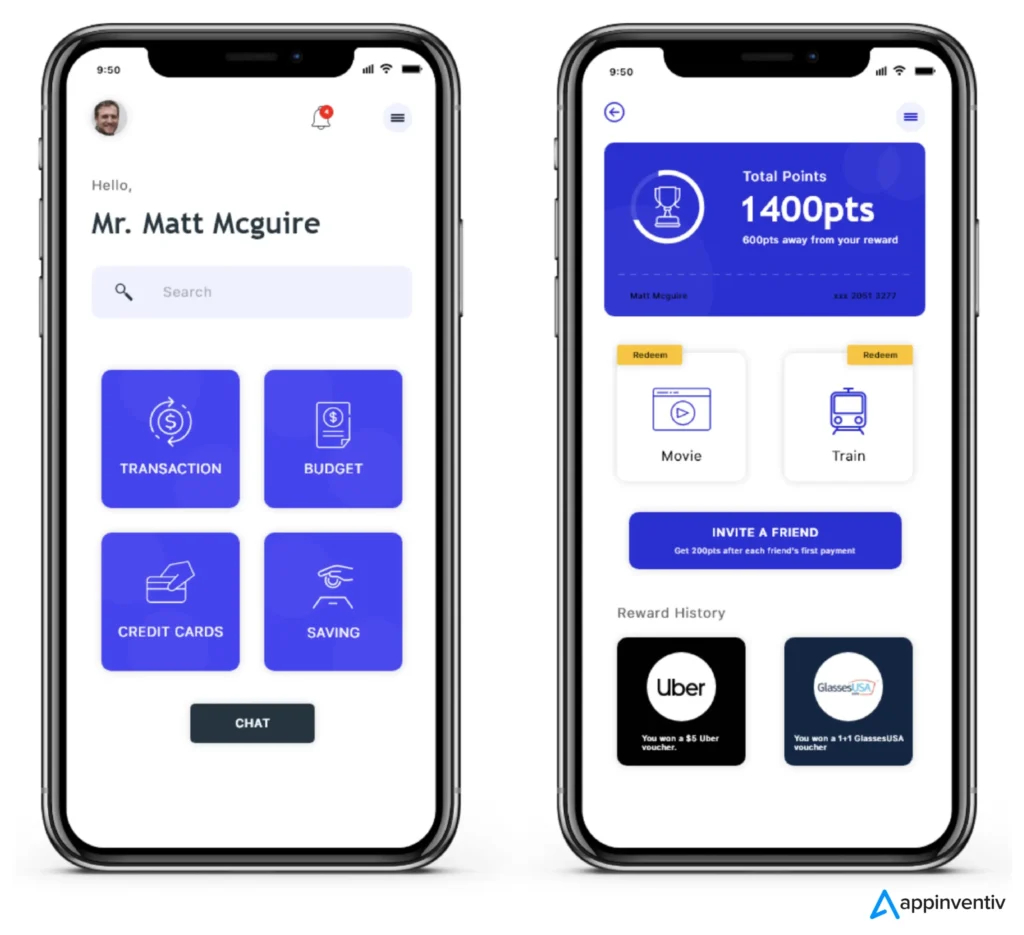

Credit: appinventiv.com

Frequently Asked Questions

What Are Budget Management Apps?

Budget management apps help track expenses, manage finances, and create budgets. They are essential for startups.

How Do Budget Management Apps Benefit Startups?

They provide financial insights, help control spending, and ensure financial health. These apps are invaluable for startups.

Are Budget Management Apps Easy To Use?

Yes, most budget management apps have user-friendly interfaces. They are designed for ease of use.

Can Budget Management Apps Integrate With Bank Accounts?

Many budget management apps integrate with bank accounts. This allows automatic transaction tracking and updates.

Conclusion

Finding the right budget management app can boost your startup’s efficiency. These apps help track expenses, manage cash flow, and plan for growth. Choose an app that fits your needs and budget. Good management is key to your startup’s success.

Start exploring these tools today. Your future self will thank you.