Freelancers need efficient tools to manage their finances. Accounting software offers a solution to track income and expenses.

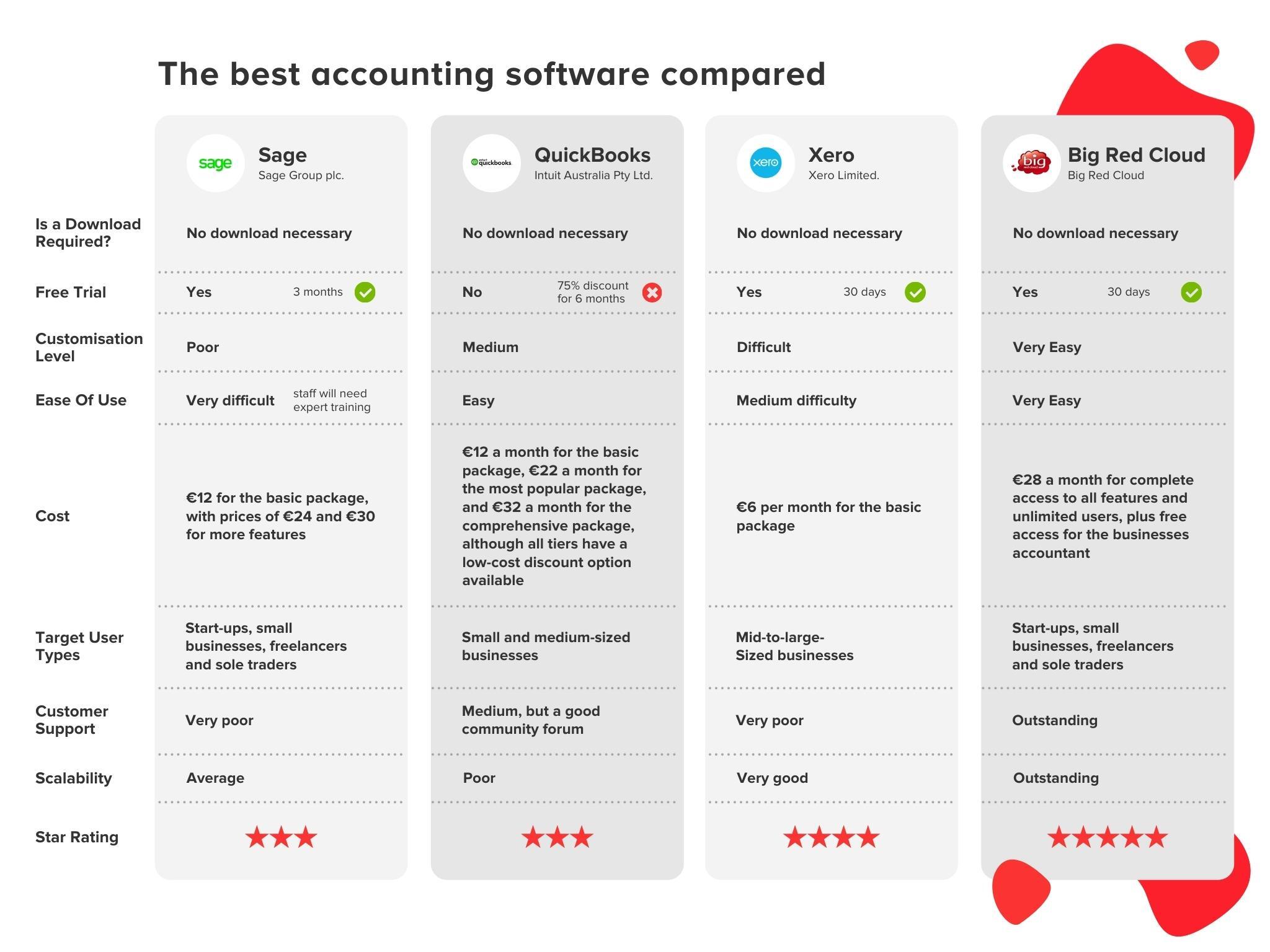

Comparing different accounting software can help freelancers find the right fit. With various options available, it’s essential to understand the features and benefits each software provides. Freelancers have unique needs, like invoicing clients, tracking project expenses, and preparing taxes. The right software can simplify these tasks and save valuable time.

This guide will explore some popular accounting software choices, highlighting their strengths and weaknesses. By the end, freelancers will have a clearer idea of which software matches their requirements.

Credit: bigredcloud.com

Introduction To Accounting Software For Freelancers

Freelancers often juggle multiple roles. They are not just service providers but also accountants. Managing finances can be a daunting task. This is where accounting software comes in. It helps freelancers track income, expenses, and taxes.

Importance Of Accounting Software

Accounting software saves time. It automates many tasks. No more manual calculations. It reduces errors. It provides a clear picture of your finances. You can make informed decisions. It keeps you organized. It also helps during tax season. You have all your records in one place.

Key Features To Look For

First, consider ease of use. The software should be user-friendly. You do not need to be an accountant to use it. Second, look for expense tracking. It should categorize expenses for you. Third, invoicing is important. The software should generate professional invoices. It should also send reminders for late payments.

Another key feature is reporting. The software should provide financial reports. You need to see your profit and loss. It should also have tax support. It should help you calculate taxes. Finally, consider integration. The software should integrate with other tools you use. This includes bank accounts and payment processors.

Benefits Of Using Accounting Software

Freelancers often juggle multiple tasks, from project management to client communication. Handling finances can become overwhelming. Accounting software simplifies this by streamlining financial processes. Let’s explore the key benefits of using accounting software.

Curious about Accounting and Finance? This post offers a deeper understanding. Top Budget Management Apps for Startups: Boost Financial Efficiency

Time-saving

Accounting software automates many tasks. This includes invoicing, expense tracking, and financial reporting. Automation reduces the time spent on manual data entry. You can focus more on your core work. With saved time, you can take on more projects. This leads to increased earnings.

Accuracy And Precision

Manual accounting often leads to errors. Small mistakes can cause big problems. Accounting software ensures accuracy. It calculates totals and reduces human error. Precision in financial records helps avoid legal issues. It also makes tax preparation easier. Accurate data provides a clear picture of your finances.

Popular Accounting Software Options

Choosing the right accounting software is essential for freelancers. There are many options available, each with unique features. Here, we will look at some of the most popular accounting software options for freelancers.

Quickbooks

QuickBooks is a well-known name in accounting software. It offers robust features that cater to freelancers’ needs. QuickBooks provides both online and desktop versions.

- Ease of Use: The interface is user-friendly, making it easy to navigate.

- Invoicing: Create and send professional invoices quickly.

- Expense Tracking: Track expenses and categorize them for tax deductions.

- Reporting: Generate detailed financial reports to understand your business performance.

- Integration: Integrates with various apps like PayPal, Shopify, and more.

QuickBooks also offers mobile apps, allowing you to manage your finances on the go. The pricing plans vary, so you can choose one that fits your budget.

Freshbooks

FreshBooks is another excellent option for freelancers. It is known for its simplicity and effectiveness. FreshBooks focuses on making accounting tasks easy.

- User-Friendly: The interface is intuitive and easy to use.

- Time Tracking: Track your billable hours and add them to invoices.

- Expense Management: Easily capture and categorize expenses.

- Invoicing: Create customizable invoices and accept online payments.

- Client Portal: Clients can view invoices and make payments online.

FreshBooks also offers excellent customer support. It has mobile apps for iOS and Android, helping you manage your business from anywhere. The pricing is flexible, with options for different needs.

Dive into Accounting and Finance and uncover valuable details in this article. Best Accounting Tools for Small Businesses: Boost Efficiency Today

Quickbooks: Features And Benefits

QuickBooks is a popular accounting software among freelancers. It offers many features to manage finances. Easy to use and packed with tools, QuickBooks is a top choice.

User-friendly Interface

QuickBooks has a user-friendly interface. It’s designed for easy navigation. Users can quickly find what they need. The dashboard displays important information. It includes income, expenses, and profit. No need to search for data. Everything is accessible with a few clicks.

Comprehensive Reporting

QuickBooks provides comprehensive reporting. Users can generate detailed financial reports. It helps in tracking expenses and income. It also assists in tax preparation. The reports are customizable. Users can tailor them to meet specific needs. This feature makes financial management easier.

Freshbooks: Features And Benefits

FreshBooks is a popular accounting software for freelancers. It offers many features to manage finances. Freelancers need a simple and effective tool. FreshBooks meets this need with ease.

In this section, we will explore its key features. We will focus on invoicing capabilities and expense tracking. These features are essential for freelancers. Let’s dive in.

Invoicing Capabilities

FreshBooks makes invoicing simple. You can create professional invoices quickly. Customize them with your logo and colors. This helps you look more professional.

The software also tracks invoice status. You will know if an invoice is viewed or paid. Automated reminders help you get paid faster. This saves time and reduces stress.

Recurring invoices are another great feature. Set them up for regular clients. FreshBooks will send them automatically. This ensures you never miss a payment.

Expense Tracking

Keeping track of expenses is crucial. FreshBooks makes this easy. You can snap photos of receipts and upload them. No more lost receipts.

The software also categorizes expenses for you. This helps you see where your money goes. It also simplifies tax time. You can generate reports with a few clicks.

FreshBooks also connects with your bank. It imports transactions automatically. You can review and categorize them. This keeps your records accurate and up-to-date.

Credit: practice.do

Dive into Accounting and Finance and uncover valuable details in this article. How to Manage Business Finances With Software: Boost Efficiency

Comparing Quickbooks And Freshbooks

Choosing the right accounting software is crucial for freelancers. QuickBooks and FreshBooks are two popular options. Both offer unique features and benefits. This section will compare QuickBooks and FreshBooks to help you decide which one suits you best.

Pricing

QuickBooks offers several pricing plans. The basic plan starts at $25 per month. It includes features like income and expense tracking and invoicing.

FreshBooks also has multiple pricing tiers. The Lite plan starts at $15 per month. It covers invoicing, expense tracking, and time tracking. Freelancers with a tight budget may find FreshBooks more affordable.

Customer Support

Customer support is vital for freelancers. QuickBooks provides 24/7 support via phone and chat. They also have a comprehensive help center. Users can find articles and video tutorials easily.

FreshBooks offers award-winning customer support. Their team is available via phone, email, and chat. Response times are quick. Users often praise their friendly and helpful service.

Other Notable Accounting Software

Freelancers often look for the best accounting software to manage their finances. While there are many options, a few stand out for their unique features and ease of use. Below, we highlight some other notable accounting software that can help freelancers streamline their accounting tasks.

Wave

Wave is a popular choice among freelancers due to its free pricing model. It offers a comprehensive range of features designed to meet the needs of small businesses and freelancers.

- Invoicing: Create and send professional invoices.

- Expense Tracking: Keep track of your expenses effortlessly.

- Financial Reports: Generate detailed financial reports.

Wave also supports integration with bank accounts, making it easy to import transactions. Its user-friendly interface ensures that even those new to accounting can manage their finances effectively.

Xero

Xero is another excellent option that offers a range of features tailored for freelancers. It provides robust functionalities that help in managing your business finances efficiently.

- Bank Reconciliation: Automatically import and categorize your bank transactions.

- Invoicing: Create custom, professional invoices.

- Expense Management: Track and manage your expenses.

Xero’s dashboard provides a clear overview of your financial health. Its mobile app allows you to manage your finances on the go, making it a versatile tool for busy freelancers.

Credit: zapier.com

Choosing The Right Software For Your Needs

As a freelancer, choosing the right accounting software can be tough. Different tools offer different features. Your choice depends on your unique needs. Let’s break down the key points to consider. This will help you make an informed decision.

Assessing Your Requirements

First, list your accounting needs. Do you need invoicing features? Do you need expense tracking? Perhaps you need both. Think about the size of your business. Are you a solo freelancer? Or do you have a small team? Your software should scale with you.

- Invoicing: Look for customizable templates and automated reminders.

- Expense Tracking: Choose software that can categorize expenses easily.

- Reporting: Comprehensive financial reports can aid in decision-making.

- Integration: Does it integrate with other tools you use? This can save time.

Consider your budget. Some software is free, but others have monthly fees. Compare the features you get for the price. Don’t pay for features you won’t use.

Trial And Error

Start with free trials. Many accounting software providers offer them. This way, you can test the software before committing. Pay attention to the user interface. Is it easy to navigate? Can you find what you need quickly?

| Software | Trial Period | Key Features |

|---|---|---|

| Software A | 30 Days | Invoicing, Expense Tracking, Reporting |

| Software B | 14 Days | Invoicing, Project Management, Integration |

During the trial period, test all the features. Create invoices, track expenses, and generate reports. Make sure the software meets all your needs. If it doesn’t, try another one. Keep testing until you find the perfect match. This process may take time. But it ensures you choose the right tool for your business.

Frequently Asked Questions

What Is The Best Accounting Software For Freelancers?

The best accounting software for freelancers depends on individual needs. Popular options include QuickBooks, FreshBooks, and Xero. Each offers unique features.

How Does Freshbooks Benefit Freelancers?

FreshBooks offers easy invoicing, time tracking, and expense management. It is user-friendly and integrates with many apps. Ideal for freelancers.

Is Quickbooks Suitable For Freelancers?

Yes, QuickBooks is suitable for freelancers. It provides robust accounting features, including expense tracking and invoicing. It is highly customizable.

Can Xero Be Used By Freelancers?

Absolutely, Xero is great for freelancers. It offers cloud-based accounting, invoicing, and bank reconciliation. It is accessible and efficient.

Conclusion

Choosing the right accounting software can simplify your freelance work. Evaluate your needs and compare features carefully. Look for user-friendly interfaces and good customer support. Consider your budget and the software’s scalability. Test a few options if possible. The right tool will save you time and reduce stress.

Make an informed decision and watch your freelancing business thrive.